Carbon Credit Market

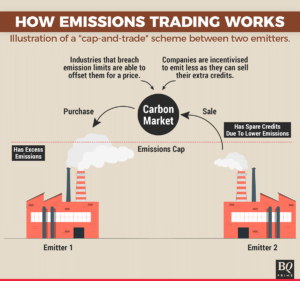

The carbon credit market is a global system for trading emissions credits. It consists of two main segments: the mandatory carbon market and the voluntary carbon market. The latter is used by companies that wish to offset their emissions on a voluntary basis, while the former is regulated through international, regional and national carbon reduction schemes (emissions trading systems) such as the Clean Development Mechanism under the Kyoto Protocol, EU Emissions Trading Scheme, California Carbon Market and others.

A credit is a unit of measurement that represents one tonne of carbon dioxide emitted into the atmosphere. Credits can be purchased and sold from projects that reduce, avoid or sequester carbon.credit in the form of afforestation, biofuels and energy efficiency upgrades. Projects must be verified by a third party and have an economic rationale. The underlying emissions reductions must be permanent and additional to those that would have occurred without the project.

The carbon credits market is a large and growing global sector. According to an estimate by the World Bank Group, by 2025, it is expected to generate revenues of over $5 billion per year. A growing number of countries are looking to capitalize on the opportunities in this space and have developed plans to integrate carbon markets into their national climate policies.

What is Carbon Credit Market?

Carbon markets are currently dominated by projects that focus on avoiding or reducing atmospheric emissions, such as planting forests and switching from fossil fuels to renewable energy. These projects account for 82% of the carbon credits market. Carbon removal projects are poised to play an even larger role in the future, but the technical and cost hurdles need to be overcome before they can gain traction. Until then, avoidance and reduction credits will continue to bridge the gap between business-as-usual emissions and carbon neutrality.

Delegates at the COP26 global climate change conference in Glasgow endorsed a set of rules that will govern global carbon markets, known as Article 6 of the Paris Agreement. These rules, which establish the terms under which countries can trade carbon credits to meet their greenhouse gas emission targets, are a critical part of the global effort to reduce climate-change risks.

To participate in the carbon-credit market, companies must first determine their climate goals and how to reach them. For most, this involves reducing carbon footprints by generating renewable electricity onsite or purchasing power from a provider that has done so. But many companies also choose to offset their remaining emissions through the purchase of carbon credits.

While this option can be a great way for companies to demonstrate their commitment to climate action, they must understand the nuances of the carbon-credits market to make wise choices about which projects to support. Often, this requires the assistance of an experienced and accredited partner like South Pole.

A key factor in the success of carbon-credits projects is transparency. But a lack of it can jeopardize the fundamental idea that each credit represents a tonne of carbon dioxide avoided or reduced. For example, a recent investigation by ProPublica found that 85 percent of the projects it examined were unlikely to achieve their claimed reductions, while opacity in the carbon-credits market has fueled a race to the bottom, where lower quality projects are rewarded with credits.