Non-Conforming Loans

Non-conforming and low doc loans are popular loan types for self-employed customers or those with a mix of credit history. These loans allow self-employed people to buy a home despite a mixed credit history. When applying for a traditional mortgage, a lender wants to see evidence of income. But for self-employed people, the lack of regular income proof makes the process much more difficult.

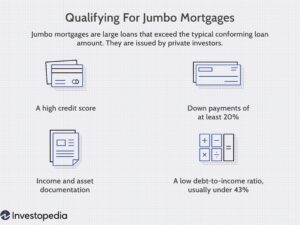

In addition to submitting the proper documentation, these loans have stricter eligibility requirements. No doc loans, on the other hand, don’t require documentation to be reviewed. If your current debt-to-income ratio is more than 50%, you will have a harder time getting approved for a loan. Low-doc loans will allow you to submit no income proof, but will require you to prove your assets.

While the interest rate of a low doc loan may be higher than that of a regular loan, it’s similar to that of a regular loan. They may even be tax deductible for your business. If you’re borrowing less than 60% of the property’s value, you’ll want to choose a non-doc loan that has a low interest rate and longer repayment terms.

Another non-conforming lender is Bluestone, which was founded by Barclays Bank and large institutional investors. While Bluestone specializes in prime low doc loans, it also offers Lite Blue, Business Easy, and prime low doc loans. However, these companies do not accept new clients at the moment. The company is a wholly-owned non-bank lender and is focused on servicing its loan books.

What Are Low Doc and Non-Conforming Loans?

When it comes to home loans, non-conforming loans are the most advantageous for those with poor or mediocre credit. They are typically smaller than conforming loans, but they can cover the entire value of the property. Unlike conforming loans, non-conforming loans can have a fixed interest rate for a certain period of time or even offer loan terms outside the standard 15-year and 30-year term.

As the market for non-conforming loans is crowded, lenders are becoming more stringent with their credit requirements. A credit score of 620 is required to obtain a conforming loan. The lender will charge a higher interest rate to compensate for this increased risk. They may also require higher down payment amounts and six months’ worth of cash in reserve. If you are considering a non-conforming loan, make sure to do your homework. If you’re new to the process, contact a mortgage broker to take the stress out of it. You’ll save a lot of time and energy if you hire someone who knows the ins and outs of the process.

A non-conforming loan can be advantageous for people who have recently filed for bankruptcy. However, these loans may not be as good for those with lower credit scores. For those with good credit scores, conforming loans are available. They usually have lower interest rates than non-conforming loans. And they may come with lower down payment requirements. But the main difference between conforming and non-conforming loans is that they are standardized.